Payday loans represent the kind of lending under which borrowers get small, short-term loans with a high interest rate that guarantee the lender so many risks and considerations. Payday loans are also referred to as cash advance or paycheck loans, since one has to borrow against their next paycheck before reaching payday. This paper portrays an overall insight into payday loans – a peek at the risks involved, other viable alternatives, and distinct vital considerations a borrower ought to be in the know of.

How Payday Loans Work

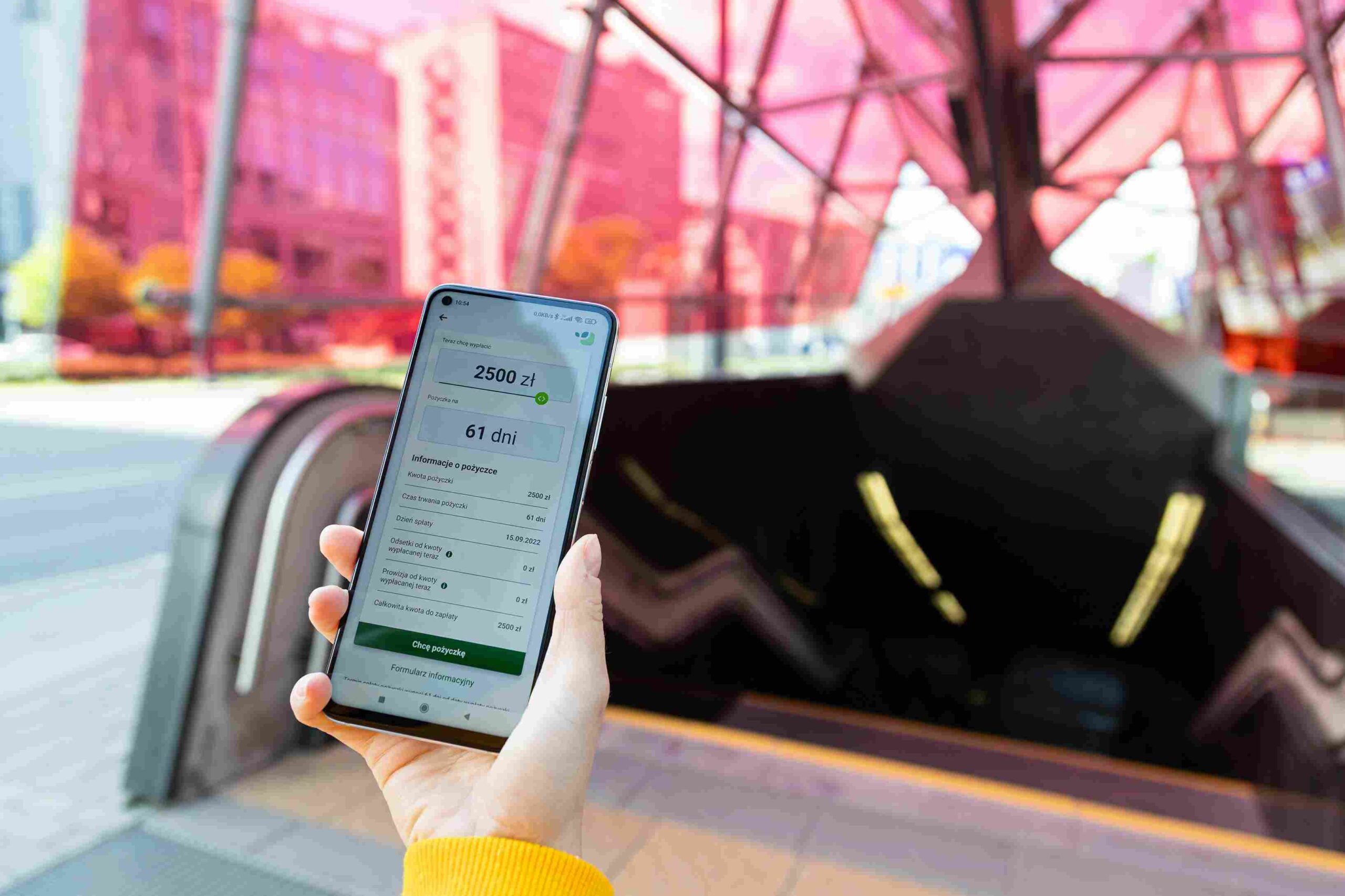

They are actually small-dollar loans, borrowed for a short term, usually from 2-4 weeks. The borrower issues a post-dated check, or provides written or electronic authorization for a debit on his checking account, to satisfy the borrowed sum on the next payday along with the fee charged. Rollover is another possibility, corresponding to a fee in addition to the borrowed sums and extending the life of the loan for another period.

Risks of Payday Loans

High Cost

More so, the annual percentage rates (APRs) at which payday loans incur are high altogether, close to 400% annually. After charges and interest, it is very possible that a borrower may end up paying much more than they actually borrowed, thus entangled in the cycle of debt.

Short Repayment Period

The time span provided by most lenders of payday loans is very short; the money borrowed, together with the fees, must be repaid in an interval of between two to four weeks. Due to these very short given periods, most borrowers are not in a position to pay the whole amount borrowed. As a result, they rollover, extend the period, or borrow more to settle the original borrowed amount together with the fees.

Debt Trap

Payday lending easily sets off a cycle of debt for consumers, since the high fees and high interest defer a borrower from paying the whole size of the loan. More usually roll over the debt that they are not able to pay in full, therefore getting more involved with financial instability and debt obligation.

Predatory Lending Practices:

Even more disreputable payday lenders may lean on their borrowers with aggressive collection scary fees. Borrower alert: Deal only with payday lenders who clearly state the terms and conditions of how a loan works.

Alternatives to Payday Loans:

Personal Installment Loans:

Personal installment loans are much the same as the payday loan, in that one still gets yet another borrowing product. Borrowers in this case, however, can get an amount that maybe bigger in volume, time, and maybe better rates. With the mentioned loan, continuous monthly payments will be made, making it a fair way through accessibility to affordable and manageable credit.

Credit Union Loans

They availed a small amount of dollar loans with favorable terms and low-cost fees than offered by traditional payday moneylenders. Small dollar credit unions provide these loans. Fairly priced, they offer practicability as an alternative to payday loans.

Emergency Savings:

An emergency savings fund can definitely save you from getting a payday loan at times of weird expenses or a serious financial emergency. Regular savings in a separate savings account would provide a cushion and lessen the need for expensive credit.

Borrowing from Family or Friends:

Borrowing from family and friends presents an alternative source for people to borrow funds without suffering the high costs and risks associated with payday loans. The borrower always has to be open with the lenders, set the clear terms of repayment, and what to stick to the agreements for a healthy relationship.

Considerations for Borrowers

Loan Repayment:

This meant that the assessment discussed the ability of the person taking up the payday loan to fully repay it at the time the loan is due, considering this person’s income, expenses, and other financial obligations. Borrow only what you can manage to repay and consider alternatives if loan repayment is impossible.

Loan Terms and Fees

Review the attached terms and fees for your payday loan cautiously, for instance, the interest rates and finance charges together with the terms and conditions specifying how and when the loan needs to be paid back. Know as a borrower what you are paying and compare it with other sources of financing to make a wise decision.

Budget Management

Thus, managing your money to a degree wherein you try not to start borrowing from payday lenders again is to allow money for regular expenses, the amount that would go to your savings, and repayments so important things of life continue properly without a debt pit.

Financial Education

Seek financial education and resources to help improve your financial literacy in order to make informed decisions with respect to loans and managing money. In grasping the main concepts associated with personal finance, techniques of budgeting and management of debt you are thus brought into the league of confidently realizing your long-run financial goals.

Conclusion

So, though payday loans are designed to provide users with virtually immediate access to money for financial emergencies, the risk and expenses associated with them seem overwhelming. Knowledge of the risk, debunking some myths about payday borrowing, taking a glance at some alternatives, and responsible borrowing all can aid people in improving the chances of not falling into the trap of borrowing and being able to become financially fit both by getting and remaining financially fit.

If a person was careful enough not to fall prey to the intricacies of the game of payday lending without harm to their financial well-being, they’d have to be following some steps, including doing attentive research, prudent financial planning, informed decision-making.

1 thought on “Payday Loans: Understanding the Risks and Alternatives”